Forte Ventures is the latest investor in K4Connect; supporting the mission-driven technology company that’s creating solutions to serve and empower older adults and individuals living with disabilities.

By: Danny Sullivan

July 10, 2020

We talk with VC investor Forte Ventures about its first foray into AgeTech, COVID-19 and the Longevity investment opportunity.

Longevity agetech company K4Connect has announced a $7.7 million finance injection, bringing its Series B VC funding round to a total of $21 million. The North Carolina based firm is a provider of smart technologies for senior living communities and serves thousands of residents at over 800 care homes, independent living and assisted living communities across the USA.

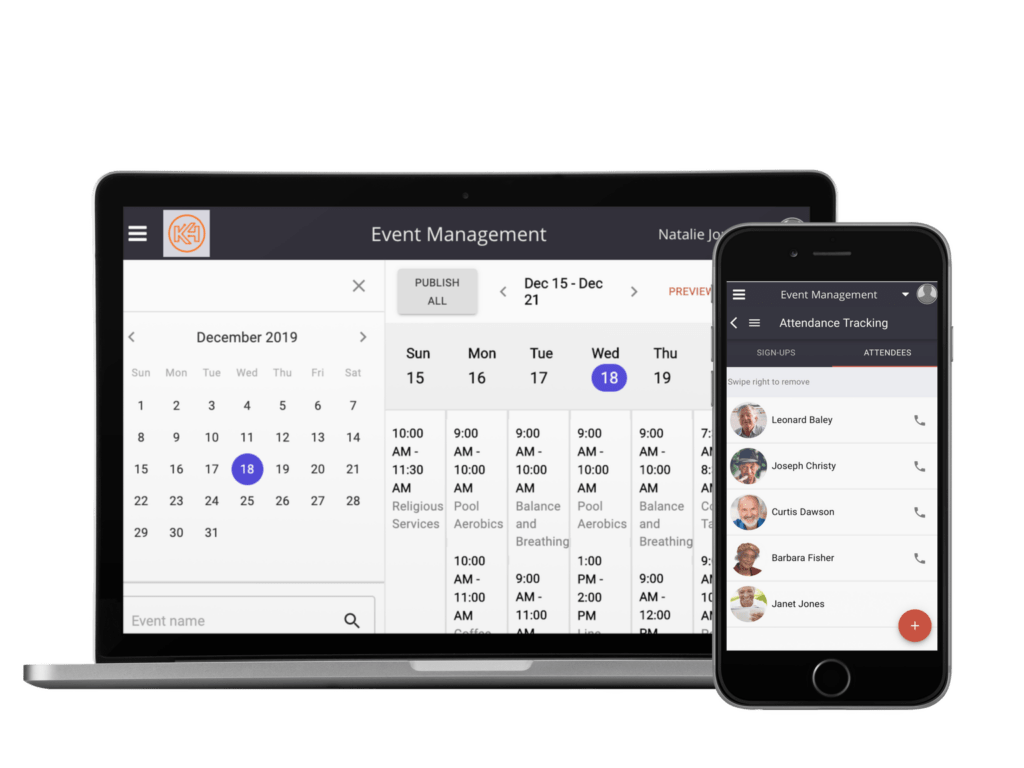

The company will apply the new funds to further accelerate the development and deployment of solutions that address the challenges brought on by COVID-19, which has had far-reaching implications for senior living. Billed as a single “operating system” for senior living communities, the K4Community solution brings together a range of smart products for residents, staff and operators in a single, simple interface.

The new funding round was led by institutional VC firm Forte Ventures. We caught up with Forte partner Louis Rajczi to find out what led his firm to get involved in its first investment in the Longevity sector.

“For K4Connect specifically, it starts with an extremely capable and experienced management team, who have “done this before” with other startup companies, and who have a commitment and belief in their mission to be able to dramatically improve people’s lives,” says Rajczi. “In addition to the team, we believe K4Connect has identified a way to successfully package and sell technology offerings into the senior living market. While the company is still at the early stages, there are clear indications that it is on the right track and fully committed to developing the customer relationships required to broaden the availability of the K4Connect solutions.”

Rajczi also points out the importance of the strong relationships Forte has with a number of K4Connect’s co-investors.

“And we know the strategic partners they have around the table, including AXA Venture Partners, Ziegler Link-Age, and Intel Capital, will bring tremendous value to help the company grow,” he adds. “We believe the combination of all these elements will position the company well for success.”

Rajczi expects the next few years to be both exciting and challenging for K4Connect – even without the extra challenges presented by the coronavirus pandemic.

“The company is at a stage now where its technology is being deployed at scale and we will soon be able to get detailed feedback from customers, not only on how well the current solutions address their issues, but also on other things they would like to see the technology do for them in the future,” he says. “It is also a time when more and more intelligent, connected consumer devices are coming on to the market that could be incorporated as part of these new solutions.”

In the context of COVID-19, Rajczi believes companies looking at buying AgeTech and care-related technologies are being impacted in the same ways as most other companies.

“Crises like these tend to expose weaknesses and faults in the “normal” way of doing business, and force companies to adapt because the old way of doing business is no longer feasible,” he says. “In some cases, it changes a “nice to have” technology to a “must have” technology, or one that would be considered as part of “next year’s budget” into one that is needed immediately. Any time there is change, new opportunities arise, and I believe investors will identify where these new opportunities are being created – including in the AgeTech sector.”

All companies are having to adapt to accommodate to the changes in the world around them, and Rajczi points out that some will do this more successfully than others.

Read more from Longevity Technology, here!